Mastering Real Estate Financing: Strategies for Long-Term Success

Welcome to the world of real estate financing, where the success of your investments depends greatly on the strategies you implement. In order to be a successful real estate investor, you must have a deep understanding of the financing process and how to utilize it to your advantage. With proper knowledge and skills, you can effectively manage and maximize your real estate portfolio for long-term success. In this article, we will delve into the various strategies you can use to master real estate financing and achieve long-term success in your investments.

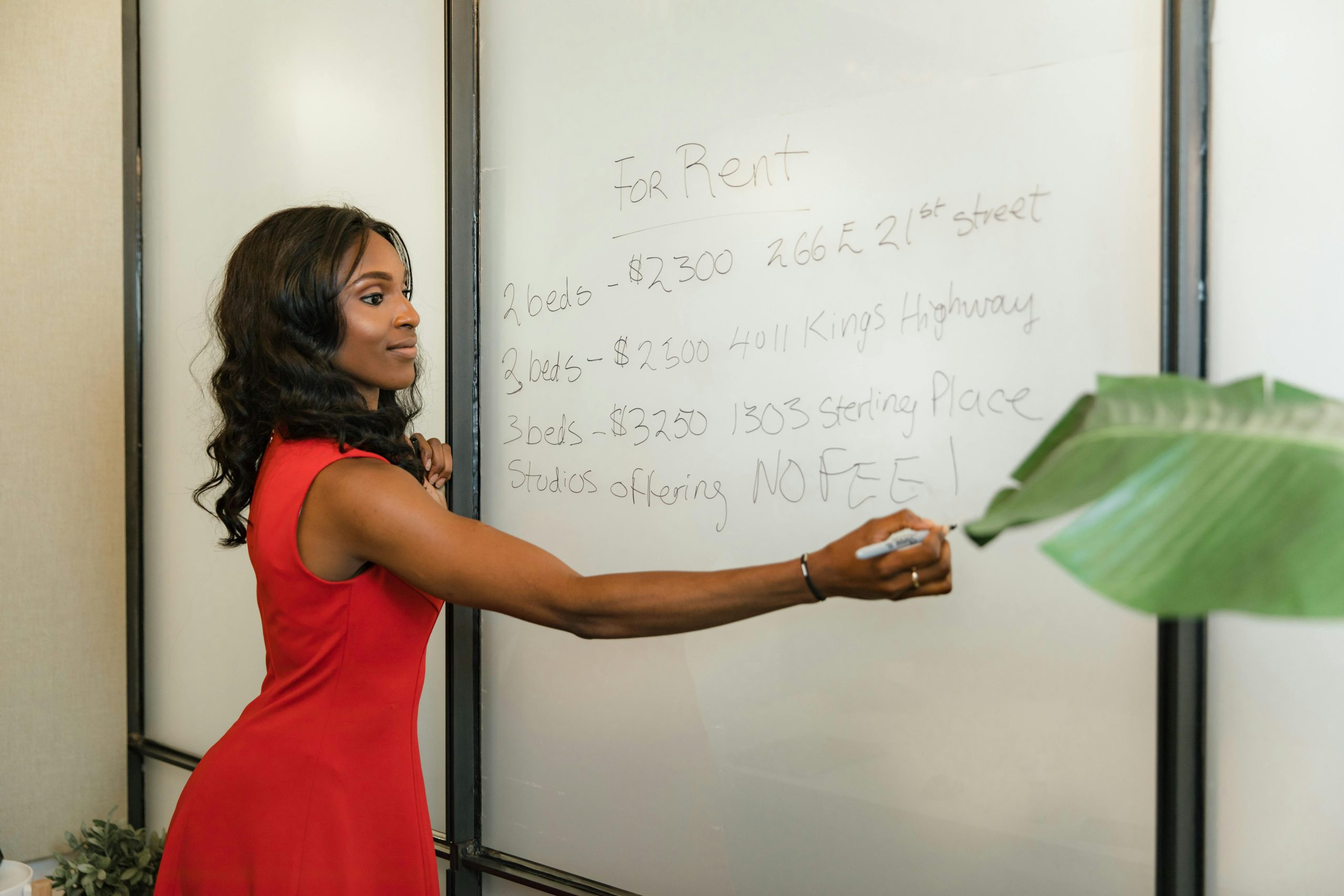

Understanding Real Estate Financing

Real estate financing is the process of obtaining funding for real estate investments. This funding can come from a variety of sources, including traditional banks, private lenders, and even crowdfunding platforms. The goal of real estate financing is to secure the necessary funds to purchase or improve a property, as well as to generate a return on investment.

Types of Real Estate Financing

There are several types of real estate financing, each with its own unique pros and cons. Let’s take a look at some of the most common types of real estate financing:

Traditional Bank Loans

Traditional bank loans are the most common type of financing for real estate investments. These loans typically have fixed interest rates and require a down payment of at least 20% of the property’s purchase price. They also have longer loan terms, usually ranging from 15 to 30 years. While traditional bank loans provide stability and predictability, they can be challenging to obtain, especially for new investors or those with less-than-perfect credit.

Private Lenders

Private lenders are non-institutional individuals or companies that provide financing for real estate investments. They offer more flexible terms and can be easier to qualify for compared to traditional bank loans. However, they often have higher interest rates and shorter loan terms, making them more suitable for short-term investments.

Crowdfunding

Crowdfunding is a newer form of real estate financing that has gained popularity in recent years. This method involves pooling funds from multiple investors to fund a real estate project. Investors can choose to invest in either debt or equity crowdfunding, with debt providing a fixed return and equity offering a share in the profits. Crowdfunding platforms offer a low barrier to entry and the potential for higher returns, but they also come with higher risks.

Mastering Real Estate Financing for Long-Term Success

Now that we have a better understanding of the different types of real estate financing, let’s explore some strategies you can use to master real estate financing and achieve long-term success in your investments:

1. Have a Clear Investment Plan

Before diving into any real estate investment, it is crucial to have a clear plan in place. This plan should outline your investment goals, risk tolerance, and preferred financing options. Having a solid plan will help you stay focused and make strategic decisions that align with your long-term goals. It will also make it easier for you to secure financing and demonstrate to lenders that you are a serious, responsible investor.

2. Diversify Your Financing Sources

Don’t put all your eggs in one basket when it comes to financing. Diversifying your sources of funding will help minimize risks and ensure you have access to multiple options when needed. If one source of financing becomes unavailable, you will still have others to fall back on. Additionally, having various financing sources can help you negotiate better terms and rates.

3. Build a Strong Relationship with Lenders

Building a strong relationship with lenders is crucial for long-term success in real estate financing. This involves staying in touch with lenders, being transparent about your investments, and proving your reliability as a borrower. By maintaining a good relationship with lenders, you increase your chances of securing funding for future investments and potentially getting better terms and rates.

4. Continuously Educate Yourself

The world of real estate financing is constantly changing, and it’s essential to stay updated on the latest trends and strategies. Continually educating yourself about new financing options and techniques can help you stay ahead of the curve and make informed investment decisions.

5. Mitigate Risks

Real estate investments come with inherent risks, but you can mitigate these risks by being proactive. This includes conducting thorough due diligence, examining the local real estate market, and having contingency plans in case things don’t go as expected. It’s also essential to have adequate insurance coverage to protect your investments.

6. Monitor and Analyze Your Investments

Finally, it’s vital to constantly monitor and analyze your real estate investments to ensure they are performing as expected. Stay updated on market trends and regularly review your financing options to determine if there are opportunities to improve your returns or reduce your risks. This will help you make necessary adjustments and ensure your investments continue to grow and generate long-term success.

Conclusion

Mastering real estate financing is essential to achieve long-term success as a real estate investor. By understanding the different types of financing, building strong relationships with lenders, and continuously educating yourself, you can effectively manage and grow your real estate portfolio. Remember to have a clear investment plan, diversify your sources of funding, and mitigate risks to set yourself up for success in the dynamic world of real estate financing.